by Jay Merkel

October 2024

As a consultant, I tend to spend my time working on what’s being asked of me. Lately, I’ve had several conversations and projects that has been asking me to do some future forecasting or Cystal Ball gazing on the subject of the proposed LCD’s dropped by all the MAC’s in April.

The two areas I’ve had the most questions are the timing of the LCD and the list of products that will be included.

- Timing of final LCD publication: Anytime between now and April of 2025 is a good guess. Per Medicare Program Integrity Manual Chapter 13 which governs Local Coverage Decisions “MACs shall finalize or retire all proposed LCDs within a rolling year of publication date of the proposed LCD on the MCD (365 days). If an unusual circumstance occurs and the MAC wishes to request an exception to this requirement, they shall notify their COR and LCD BFLs at least 21 business days before the one year expiration date”. So asking for an extension is possible, but after a false start in 2023, the cohesive and intensive nature of the literature review sends a message that the MAC’s are serious and to date I haven’t heard of anything that would qualify as an “Unusual Circumstance”

- Timing of final LCD implementation: Once the final LCD is published, per the same manual, it is automatically effective on day 46. “The date the final LCD is published on the MCD, marks the beginning of the required notice period of a minimum 45 calendar days before the LCD can take effect. If the MAC would like to extend the notice period, they shall seek approval from CMS BFL. If the notice period is not extended by the contractor, the effective date of the LCD is the 46th calendar day after the notice period began.” Again, here an extension is possible but would require an action from the MAC’s.

Products:

I’m sure we’ve all seen the list of 15 products on the LCD and the LCD document explains in a detail every piece of high-level evidence used to decide who to include and conversely who did not get included. I’m not an expert in evidence generation but in my roles as a marketer and market access leader, I’ve read lots of studies as a non-expert. In general, we can agree that the products that were included on the list had more and higher-level evidence than those that did not make the cut.

Here are some interesting facts about the approved products.

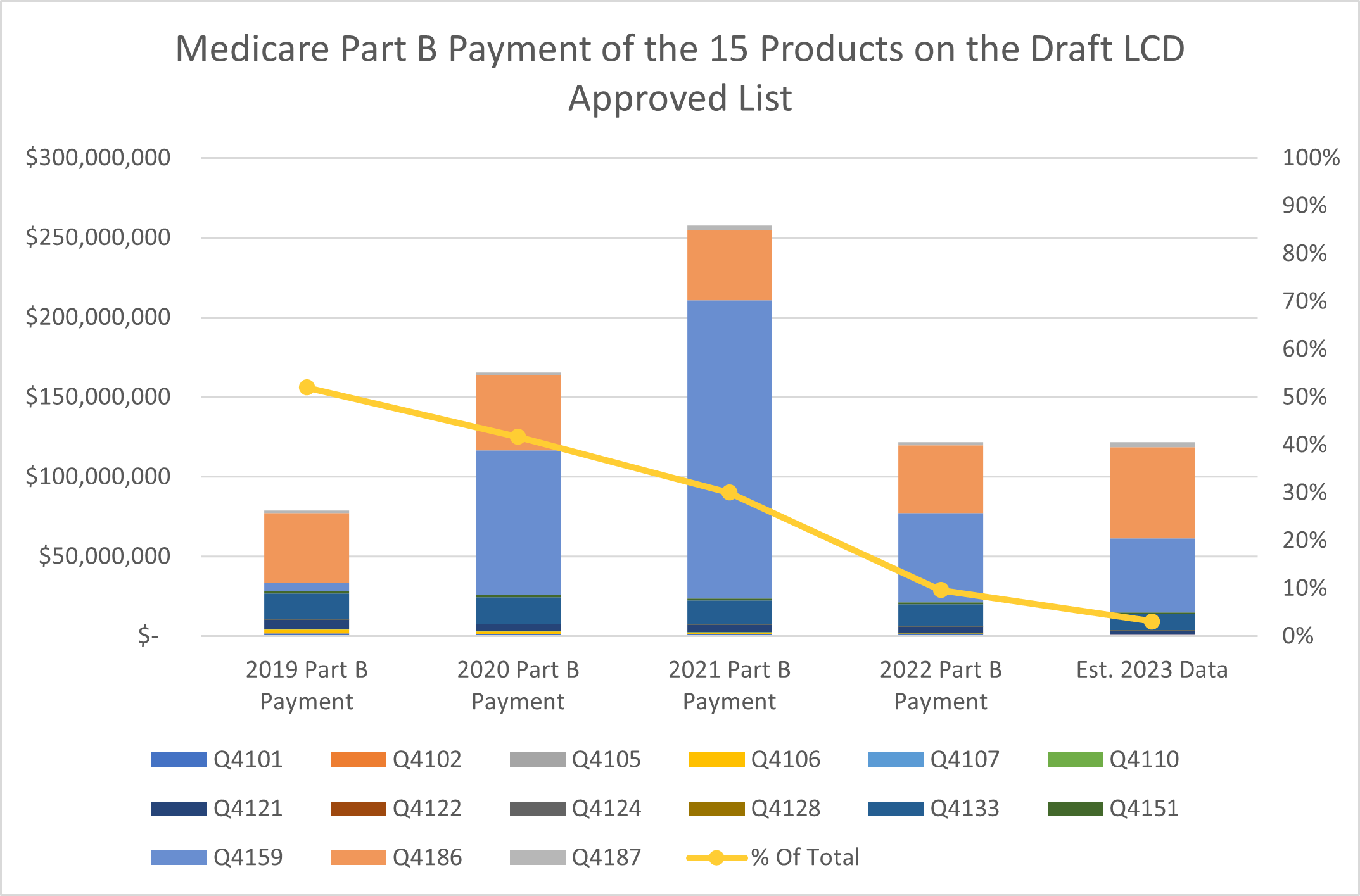

- I pulled the Medicare Part B drug payment for this group and found that these products had been growing in sales from $79MM in 2019 to a high of $258MM in 2021 before dropping down drastically to $121MM in 2022.

- More interestingly though is when you look at these product payments as a % of the total Part B payment to Skin Substitutes. In 2019, this group of 15 amounted to 52% of the overall. By 2022 it’s less than 10% of the total payment by Medicare. By 2023, I believe these products will make up only 3% of overall part B payment and I expect even less in 2024. See Chart.

- You can tell from the chart that 2 products dominate sales of the 15 with up to 90% of the total part B payments going to just those 2 products. Part of that is because many of the 15 approved products are targeted to an in-patient or out-patient space so their revenue dollars wouldn’t show up on this chart which only captures those place of service (POS) that are paid under the Physician Fee Schedule (PFS). The other part of course is that they are two of the more expensive products on the list.

- Two years ago, for the Quarterly ASP file period of Oct 1, 2022 – Dec 31, 2022 periods, only 16 products were listed. This had been approximately the same number for the previous Quarters and years. Today the same ASP file 2 years later list 104 products. However, 10/15 products approved on the LCD were on that old ASP list 2 years ago.

- CMS does not take product pricing into consideration but speaking of ASP, the 15 approved products average ASP is $97.92 (Per the latest published ASP list) with a range of $9.16 – $263. Meanwhile the average for the entire list is $769 and the highest ASP product is $3,460. That $3,460 product is not an outlier as 16 products on the ASP list are over $2,000 per cm squared.

The question is will the MAC’s include more products than these 15? I leaned towards yes. Several companies presented evidence during the open comment period that was missed by the MACs. Much of this was simply because the evidence was published after the literature pull was done, and so there is no reason for the MAC’s to not approve these products.

Here are some other questions that will impact our industry that I’ll make a quick guess on without going into the details of my why I lean that way.

Q: What about products in the middle of a study? Crystal ball says: MAC’s will want to see final results before they get approval.

Q: How does a new product get on the approved list. Crystal ball says: Manufactures will have to use the LCD reconsideration process, maybe the MAC’s can open up this process on an annual basis to add new products.

Q: Will we be given more than 4 applications? Crystal ball says: It’s possible. There was good evidence presented on why more applications are needed and giving 6-8 applications upfront may reduce documentation workload on the provider.

Q: What about wounds that are not DFU and VLU? MAC’s say those wounds will be adjudicated on a case-by-case basis on medical necessity. That answer didn’t come from my Crystall ball, it was stated by almost every MAC during their open meetings.

About the author

Jay Merkel is a retired healthcare executive, an independent consultant, and a big nerd. Prior to retiring, Jay was the Chief Commercial Officer at a Digital Orthopedic start-up called MY01 overseeing Sales, Market, Clinical, Professional Education, Reimbursement as well as getting entangled in Compliance and Supply Chain. Before MY01, she was involved in strategy, marketing, health economics and market access within the wound care space for Integra Life Sciences and ACell (acquired by Integra). Earlier in her career, she led the V. Mueller team at Carefusion (acquired by BD). Ironically, Jay started in Medical Devices as an R&D engineer out of college for BD before moving on to doing product management and product management leadership roles for Aesculap (a Division of B. Braun) and Olympus. She has worked in Surgical Instruments, Laparoscopy, Ortho-Biologics, Endoscopy, Respiratory, Surgical meshes, Closure technologies, and SPD products in addition to wound care. Her love of learning has focused her current consulting work on Market Intelligence, Commercialization and of course the ever-changing world of Reimbursement. When she is not working, she is enjoying time with her family, reading mystery novels, cooking and finding the best places to eat.

Jay Merkel is a retired healthcare executive, an independent consultant, and a big nerd. Prior to retiring, Jay was the Chief Commercial Officer at a Digital Orthopedic start-up called MY01 overseeing Sales, Market, Clinical, Professional Education, Reimbursement as well as getting entangled in Compliance and Supply Chain. Before MY01, she was involved in strategy, marketing, health economics and market access within the wound care space for Integra Life Sciences and ACell (acquired by Integra). Earlier in her career, she led the V. Mueller team at Carefusion (acquired by BD). Ironically, Jay started in Medical Devices as an R&D engineer out of college for BD before moving on to doing product management and product management leadership roles for Aesculap (a Division of B. Braun) and Olympus. She has worked in Surgical Instruments, Laparoscopy, Ortho-Biologics, Endoscopy, Respiratory, Surgical meshes, Closure technologies, and SPD products in addition to wound care. Her love of learning has focused her current consulting work on Market Intelligence, Commercialization and of course the ever-changing world of Reimbursement. When she is not working, she is enjoying time with her family, reading mystery novels, cooking and finding the best places to eat.

The views and opinions expressed here are those of the author and do not necessarily reflect official policy or position of any other agency, organization, employer or company.